Imkong Walling

Dimapur | May 30

In the first of a two-part series on statutory (direct) taxation or the lack thereof in Nagaland, the spotlight was broadly on the role of revenue in governance juxtaposed with a population unreceptive to direct state taxation. The second part seeks to clarify a perceived misinterpretation, and the connected apprehension, of the procedure for determining urban property tax in the now repealed Nagaland Municipal (NM) Act, 2001.

The formula adopted by the Guwahati Municipal Corporation is used as a comparative model. For perspective, the Guwahati Municipal Corporation’s revenue from property tax was tipped at Rs 110 crore in 2022-23.

Determining Property tax

Calculating property tax is not as straight forward as determining prefixed interest on a given amount. It requires determining two factors first— the annual valuation of a property, generally expressed as the Annual Rateable Value (ARV) followed by the rate of tax.

The ARV can be imagined as a percentage of the value of a landed property, inclusive of the preexisting market values of the land and structure. The rate of tax is calculated as a percentage of the ARV. It is to be noted that the ARV and rate of tax would be subject to the prevailing municipal taxation laws and variables like location, the type of the building and nature of the property— either commercial, private or vacant land.

For instance, the Guwahati Municipal Corporation (GMC) takes into account a number of variables, including rebates. As per the existing GMC guidelines, the ARV is calculated as 7.5 percent of the land and building cost. For vacant land, the ARV is 5 percent.

The rate of tax is 15 percent of the ARV for commercial/rented property and 10 percent for private residences. It also provides for a 10 percent maintenance/repair rebate and an additional 25 percent rebate, if a property is used exclusively for self-residence.

For ease of understanding, imagine a self-occupied ‘Assam Type’ property worth an estimated Rs 10 lakh. Using the GMC guidelines as the yardstick, the ARV of the property would translate into Rs 75,000. As a residential property, it would be eligible for 25 percent rebate, further reducing the ARV to Rs 56,250. From this total, deduct an additional 10 percent as maintenance discount, which would further reduce the ARV to Rs 50,625. Now, the annual property tax would be 10 percent of Rs 50,625, which would work out to Rs 5062, excluding sanitation and other service charges.

If Nagaland embraced property taxation, such a formula would have been applied in the municipal areas more or less.

The procedure for determining the ARV and rate of tax was spelled out in the repealed NM Act. It was specified in sections 123 (Rate of tax on lands and buildings) and 125 (Determination of annual valuation) found in Chapter-II of Part-IV, titled— Tax on lands and buildings.

As stated in section 125 of the repealed Act, the “annual valuation” or ARV was capped at 10 percent of a property’s total value. It also had a proviso that “different percentage may be determined for different categories of lands and buildings,” besides a discount of 10 percent as maintenance rebate. As per Section 123, the rate of tax was capped at 15 percent of the ARV.

Section 183 provided for a further 10 percent rebate, if the property tax is paid on or before due date. In the case of vacant land, the ARV was fixed at 5 percent of the market value of the land.

Prior to the repeal, the section pertaining to ‘tax on lands and buildings’ (property tax) was ‘omitted’ via an amendment in 2016. Objection to the choice of the word— ‘omit’ over ‘delete’ and renewed opposition to the provision for 33 percent seat reservation for women ensured the demise of the NM Act, earlier in March, this year. It not only delayed Urban Local Body elections but also deprived Municipalities of one of their main sources of revenue.

Revenue for urban amenities

To go back to the Revenue official, quoted in the previous part, “Municipal organisations need revenue for maintaining urban amenities too.”

He further said that, unlike now, municipal bodies in Nagaland would not have grounds enough to blame lack of avenue for revenue when performance falls below expectation. Besides, the residents would have good reason for demanding better urban amenities.

“At some point, those who are rich enough and those who have land will have to bear some burden. We are unwilling to let go of the land owner mentality, the sense of entitlement needs to change,” he added.

Dr. N Janbemo Humtsoe, an educator by profession, summed it up in one of his articles to the newspapers in March this year. “Urban local bodies are an important institution that enjoys political, fiscal and administrative autonomy within the limits set by laws of the county, to promote development and provide economic necessities of the region.” According to him, municipal bodies are “perhaps the first step for self-governance.” He held that the absence of full-fledged municipal bodies aligns with the “mess and lack of basic facilities in our towns and cities.”

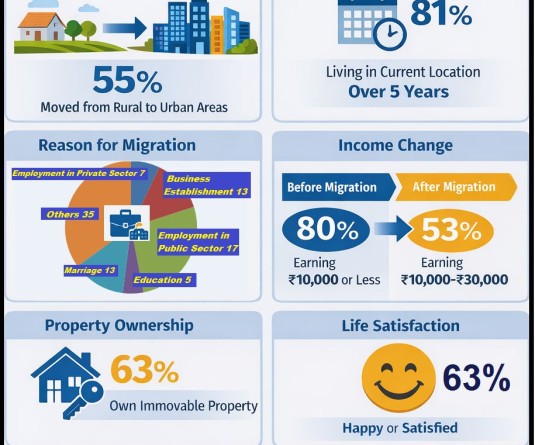

Dr Humtsoe, with a PhD in Economics is also the author of Human Capital, Income & Employment in Nagaland, published by Heritage Publishing House in 2022.

This concludes the two-part series on statutory (direct) taxation or the lack thereof in Nagaland.