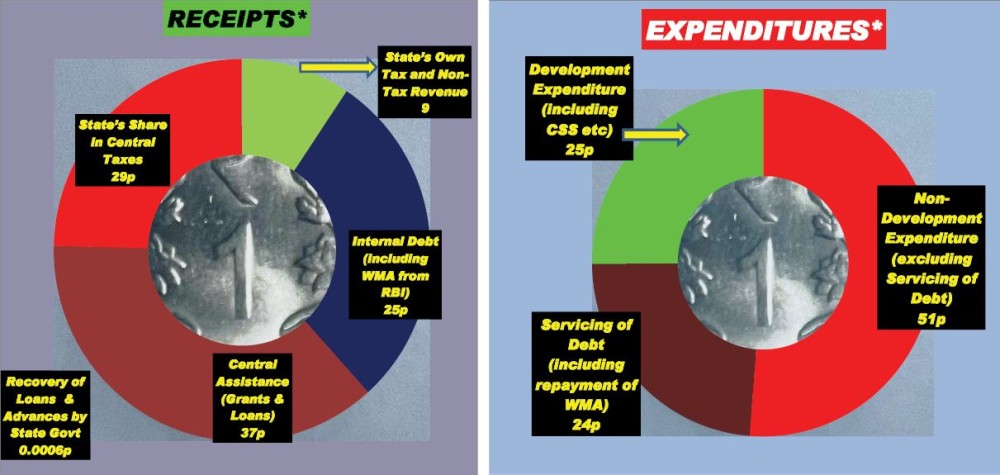

*Chart based on Budget Speech for 2024-2025 by Neiphiu Rio, Chief Minister and Minister-in-Charge, Finance on March 27, 2024. The actual figures may vary slightly due to rounding off.

Spent 75p of every one rupee on servicing debts & non-development activities

Moa Jamir

Dimapur | March 31

The financial health of the Nagaland Government has 'slightly' improved in recent years, but for every rupee the State receives, still around 91 paise (p), comes from outside, reflecting persistent dependency on funds from external sources.

In the budget speech presented in the Nagaland Legislative Assembly on February 27, the State Chief Minister and Minister-in-Charge of Finance estimated gross receipts of Rs 23978.05 crore for FY 2024-25.

Conversely, the gross expenditures were estimated at Rs 23727.88 crore. This would result in a surplus of Rs 250.17 crore, but with a Public Account (Net) of Rs. 270 crore (-), the current year’s transaction was estimated to have a negative balance of Rs 19.83 crore.

Besides, with a negative opening balance of Rs 885.95 crore, the year 2024-25 was estimated to close with an accumulated deficit of Rs. 905.78 crore, the CM highlighted.

Due to improvement in receipts, the closing accumulated deficit has reduced from the estimated closing amount of Rs 1374.17 crore in the Budget Estimates to Rs 885.95 crore in the Revised Estimates, he stressed.

However, the real status of the economy and financial health are reflected in the item-wise breakdown of the gross receipts and expenditures.

As a new financial year (FY) begins on April 1, The Morung Express presents a lowdown on 'Where a Rupee Comes From' (receipts) and 'Where a Rupee Goes to' (expenditures) in Nagaland, presenting an overview of the State’s economic health in the process.

‘Where a Rupee Comes’

Out of every rupee earned, a mere 9p is estimated to be internally mobilised. Accordingly, the State’s Own Tax and Non-Tax Revenue is estimated to be Rs 2250.05 crore, or around 9.38% of the total projected receipts of Rs 23978.05 crore.

The internal revenue stood at Rs 1708.11 crore in 2022-23 and Rs 1950.56 crore in 2023-24, reflecting an improvement, but still inadequately low collections.

During the same periods, around 93p and 92p respectively were estimated to be realised either from outside or via borrowings which falls to 91p in 2024-25.

Another item in the receipts without liability was the State’s Share in Central Taxes which was estimated to be Rs 6,940.56 crore in 2022-25 or 29p per rupee, up from Rs 5,812.05 crore in 2023-24.

Collectively, both items contribute to around 36p for every one rupee the State receives in its coffer.

With Recovery of Loans and Advances by the State Government estimated at just Rs 1.51 crore, the rest – around 74p for every rupee comes with certain conditions or future liabilities.

Thus, the biggest contributor to the State’s gross receipts was the Central Assistance (Grants & Loans) at Rs. 8880.11 crore or around 37p for every rupee, an increase from around 35p last fiscal.

However, there was a fall in another big item with liability - Internal Debt (including WMA from RBI) which is estimated at Rs. 5905.82 (25p per rupee) crore, down from Rs. 7330.91 crore in 2023-24.

The State Internal Debt reflects borrowing from various sources including Ways and Means Advances (WMA), a short-term loan from the Reserve Bank of India (RBI) to tide over temporary financial requirements.

The improvement in the State’s Own Tax and Non-Tax Revenue could be a contributing factor.

As per the 'Explanatory Memorandum' laid before the State Legislature along with the budget, the biggest item of internal debt for 2024-25 was Rs 3500 crore as WMA from the RBI and Rs 2305.76 crore loans from the Open Market.

Thus, for every rupee Nagaland receives, 74p comes with liabilities in terms of high-interest rates and, at times, political implications.

‘Where a Rupee Goes’

The receipts of the State Government can serve as an indicator of its spending.

With most earnings with high liabilities, therefore, most of the Rs 23,727.88 crore expenditures incurred are estimated to be used for non-developmental activities as well as servicing of debt.

Out of the total, the budget 2024-25 estimated a sum of Rs 12,163.90 crore is slotted as 'Non-Development Expenditure (NDE).'

Out of the total NDE, most was estimated to be spent on 'Salary & Wages' at Rs 7252.58 crore in 2024-25. Further, payment for 'Pensions' was estimated at Rs. 3557.05 crore. Collectively, expenditures on 'Salary & Wages' and 'Pensions' stood at Rs. 10,809.63 crore or around 87% of the total NDE.

Further, Rs 5,611.87 crore is estimated to be used for Servicing of Debt (including repayment of WMA).

Accordingly, for every one rupee expenditure Nagaland incurs, around 75p is estimated to be spent on NDE (51p) and Servicing of Debt (24p).

Hence, the funds left for Development Expenditure, including those received for Centrally Planned Schemes (CPS)/Centrally Sponsored Schemes (CSS), stood at just Rs. 5,952.11 cr or around 25p per rupee.

While the allocation implies an increase from Rs 4168.63 cr in 2023-24, a major portion comprised of funds under CSS and other central projects.

Nagaland's total Debt & liabilities stood at Rs 18,658.41 crore as per the 2024-25 budget estimates with Debt as % of GSDP at 38.57.

Hence, while internal revenue has increased, as the new FY begins, Nagaland should aim to decrease persistent pattern of high external dependency and focus on mobilising more internal resources.

Nagaland Budget 2024-25 Estimated Gross Receipts & Expenditure | |

A: RECEIPTS | (Rs in crore) |

State’s Own Tax and Non-Tax Revenue | 2250.05 |

State’s Share in Central Taxes | 6940.56 |

Central Assistance (Grants & Loans) | 8880.11 |

Internal Debt (including WMA from RBI) | 5905.82 |

Recovery of Loans and Advances by State Govt | 1.51 |

Total Receipts | 23978.05 |

B: EXPENDITURES | (Rs in crore) |

Non-Development Expenditure (excluding Servicing of Debt) | 12163.90 |

Servicing of Debt (including repayment of WMA) | 5611.87

|

Development Expenditure (including CSS etc) | 5952.11 |

TOTAL EXPENDITURES | 23727.88 |

C. BALANCE (A-B) | 250.17 |

D. PUBLIC ACCOUNT (NET) | (-)270.00 |

E. CURRENT TRANSACTIONS (C+D) | (-) 19.83 |

F. OPENING BALANCE | (-)885.95 |

G. ACCUMULATED DEFICIT (E+F) | 905.78 (-) |

Table based on Budget Speech for 2024-2025 by Neiphiu Rio, Chief Minister and Minister-in-Charge, Finance on February 27, 2024.