Representational images

Taxation a strong moral justification to hold govt accountable

Imkong Walling

Dimapur | May 23

Taxation, of the statutory kind, is regarded an essential to the economy as governance is to a state. In an ideal scenario, it is what funds governance from security and infrastructure to welfare and salaries or in other words, turning the wheels of state-building. As commented by a Revenue officer, “Tax is essential for any government to work ... That’s what turns the wheel. How would any economy run without taxation?”

The inferred “wheel” however is severely jammed in Nagaland with little to no means of state revenue turning it as would a conventional economy.

Blame it on the cultural mores of a supposedly tax-free past, hostility is what greets the slightest mention of ‘direct taxation’ by the state. The perceived opposition revolving around, as the story goes, unique folk practices, wherein there was no place for taxation as it is known today. The anti-tax worldview further cemented by Scheduled Tribe (ST) status and a Constitutional guarantee called Article 371 (A), vesting on the indigenous people insurmountable rights over their “lands and its resources.”

Why the hostility?

The all-India Revenue officer (name withheld on request) was asked if it was the ST status and the rights guaranteed by Article 371 (A) or trust deficit between the people and the government or deliberate ploy to keep direct taxation at bay.

His answer did not put the blame entirely on any. According to him, the ST status and Article 371 (A) are being “overused.” “I feel, many a time, trust deficit is used as an excuse.” On the same breath, he added, “But then, I don’t think we can afford to go on using folk customs as an excuse to oppose (direct) taxation.”

“If one is distrustful of the government, insist on transparency. When we start paying, we’ll start realising the value of public funds. We’ll also have a strong legal and moral justification to hold the government accountable.”

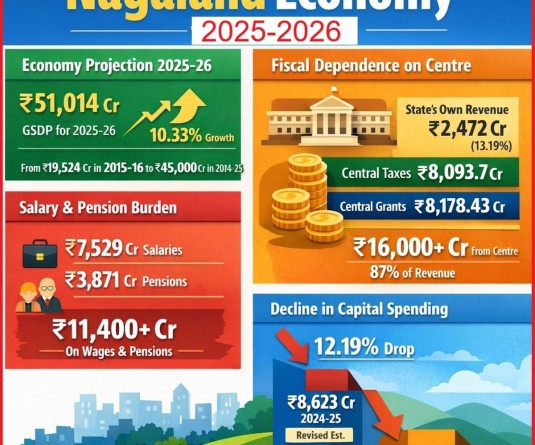

While the argument against direct taxation would have legal grounding, from an economic perspective, he maintained that it is doing more harm than good. According to him, Nagaland cannot afford to forever entirely depend on the Central government, which also implies Income Tax payers in other states, if the state wants to be self-reliant. “Nagas take pride in being tax-exempt but the reality is that 90 percent of our expenses are met by the Centre,” he held.

Generally, for every rupee raised by the Government of India, 60 paise is through internal taxation, while the rest is mobilised through borrowings from financial institutions.

In the case of Nagaland, internal revenue makes up around 10 percent. Citing the state Budget report for 2023-24, he said that only 10 percent of the state expenditure was met by revenue generated by the state government. “The rest, we are dependent on the Central government,” he reiterated, while adding that the onus should be to help narrow the unenviable gap.

The internal revenue for Mizoram, with a comparatively lesser population than Nagaland, was around 15 percent of the state’s total revenue in 2022-23. In the same period, Assam’s was 27 percent.

At present, hardly anyone is concerned because “it is not pinching the general citizenry as much.” However, he held that there would come a point when a direct taxation regime would become obligatory. From a no tax system, he said, “We may jump into a situation when anyone, with a means of income, would be regarded as a potential tax-payer.”

“The sooner we get used to the idea of taxation, the better prepared we would be to absorb tax shock in the future,” he added.

Professional Tax

Meanwhile, contrary to popular notion, Nagaland is not entirely tax-exempt. The state has a ‘Professional Tax’ or the Nagaland Professions, Trades, Callings and Employments Taxation Act, 1970, already in operation. How much of an impression it makes on the state’s overall domestic revenue could not be officially accessed but the Revenue official revealed that Central government employees, including those from the ST category, posted/working in Nagaland are mandatorily paying it.

“I don’t know if the state government employees are liable to pay but I am paying. It is not a big amount. Comes to around Rs 200 something for me a month,” he said.

Then again, there is indirect taxation, in the form of consumption or service tax.

This is the first of a two part series on statutory (direct) taxation or the lack thereof in Nagaland.