Dimapur, October 31 (MExN): The taxes department, through the DIPR has made a clarification with regard to the recent change in the rate of tax from 12% to 18% with effect from July 18, 2022, for the benefit of stakeholders.

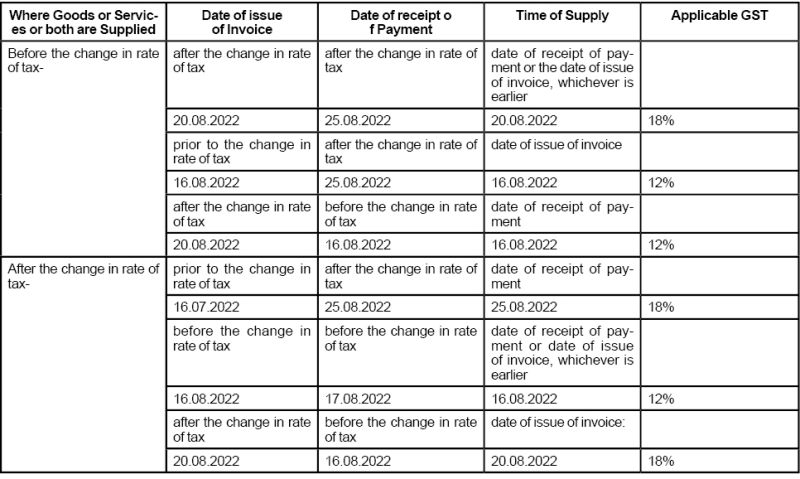

To clear confusion among stakeholders especially work contract service suppliers as to the correct application of the tax rate on ongoing works contract services, the matter was examined and it has been clarified that “where there is a change in the rate of tax in respect of goods or services or both, the time of supply as outlined in section 14 of the NGST Act, 2017 shall determine the correct rate of tax.”

Section 14 of the NGST Act, 2017 is briefly illustrated for general guidance and reference by all concerned. (See table)

Further, it pointed out that "the date of receipt of payment" shall be the date on which the payment is entered in the books of account of the supplier or the date on which the payment is credited to his bank account, whichever is earlier.

Therefore, it has been clarified that when there is a change in the rate of tax, the correct application of the tax rate shall be determined on the basis of time of supply as prescribed under section 14 of the NGST Act, 2017, it added.