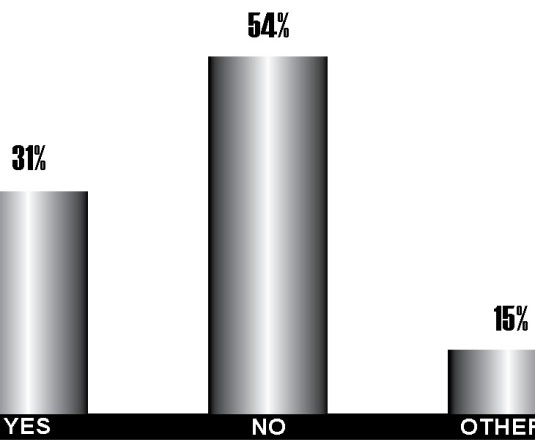

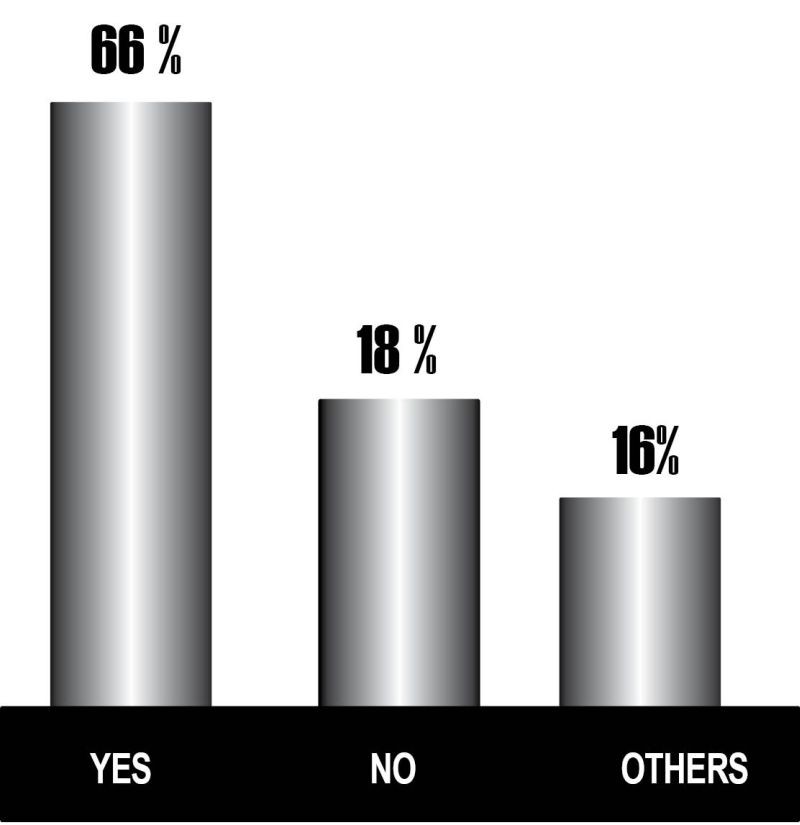

Some of those who voted YES had this to say:

• Yes. It is a shame that in Nagaland we still have to bear the brunt of "illegal" taxation even in this 21st century. People everywhere pay income tax to the Government and which is used for essential public works, infrastructure, roads and what not. But here in Nagaland it’s the opposite. We pay numerous taxes to numerous organizations to play empty trumpets. How will our economy grow when small/large businesses cannot even keep themselves afoot due to this taxation.

• Yes to some extent. Business establishments pay the tax and consumers bear the brunt of price rise.

• Of course Yes. So many people have become like a pack of hyenas and jackal in Nagaland especially in Dimapur. Those people they won't work and they let others work and try to steal from their hard earned income. Apart for illegal collection of taxes. Corruption is everywhere. Starting from the butcher who never gives the customer the right amount of meat as per the weight. The police personal who are the most corrupted whenever given a chance. They won't stop at anything to collect money in the name of fines and taxes in every gate and traffic points.

• Yes, taxation is biggest barrier, the second is election expenditure and the third will be corruption at all levels. We have to change all the systems, only then we can expect development in Nagaland. Let our people think seriously to bring about change to our land. If 12 disciples could change the world upside down, a dozen thinkers of the Nagas should be able to bring about change to this sick society.

• Yes! Illegal taxes imposed by the police and different groups are the two main barriers. And these are the reasons why the MNC's are disinterested in investing in North East, particularly Nagaland, though we are blessed with rich natural resources! Without FDI our State will not be a sustainable state.

• They are the parasites who get involved in every small development for their tax. These parasites bring corruption to our state.

• Illegal taxation by the state government workers and others make life hell for the citizens, it has gone on for so long as the state government is a key player in the illegal taxation in one way or the other. This has effective the prices of the goods public have to pay.

• We allow illegal taxation that’s the problem.

• Yes, but there's a greater need to study why the illegal taxation takes place. Only then the roots to the illegal taxation can be cleaned. Transparency and open-minded approach towards the business can lead to better economic growth and development.

• Discouraging the entrepreneurs to explore new business avenues.

• Of course both from underground and over ground in the name of freedom. It is a fail state.

• Illegal taxation or legal taxation has a same meaning in Nagaland because both ends up in building personal property instead of building development and economy growth.

• If there was something more factual than universal fact then that would be it.

Some of those who voted NO had this to say:

• “Illegal taxation” is just one out of many evils. What about the Nagaland Government who had been siphoning public money into their own pockets and banks for how long? The so called, “Illegal Taxation” is being done brazenly in public that is why they are talked about. The later (Government) is a professional looter, as they know where the fund comes from, where it will be hidden and how to hide it, the public is ignorant and is kept in ignorance, and what about our own elected ministers who are modern day Robin Hood turned Rouge. The three taxation walla (national workers), - government (public servants) and ministers (elected servants) are the biggest hindrance to the economic growth and development of Nagaland and Hallelujah we all created and elected them, so public is also the major bump in the road (where is the road)!

• No, rampant corruption at every level is the barrier. People have developed a culture of getting easy money and very less hard work.

• Both the illegal taxation and COVID-19 SOPs like lockdown and social distancing are making the biggest barrier to economic growth and development in Nagaland.

• No. It's just a small part of the barrier. The primary reason for the slow growth in our economy is the worseness of road condition.

• No we people are just lazy to build our Nagaland.

Some of those who voted OTHERS had this to say:

• Not the biggest but yes it plays s big role in being a hindrance. The biggest barrier is the corruption from all sections of society.

• Corrupt mentality of Nagas from common Nagas to govt officials. Tax is just a pocket money.

• would say if Nagaland government can't give jobs to every individual educated Naga unemployed youth Than the only solution is to demand to help create a safe environment for Naga entrepreneurship, rules and regulations, checking of illegal tax and I believe that capitalism is the best for any growing economy and that every individual who runs business should give tax to state govt. Rather than pay tax illegally.

• Illegal taxation is of course the hindrance to economic development of an individual but not the greatest; the greatest hindrance is non-transparency in state development fund, employment opportunities and etc. The Corrupt and Selfish leaders in each organisations, Institutions, Committees OR any group in the society... attributes to weaken the economic conditions of our People. May God save our Land.

• Illegal excessive taxes as well as corruptions in every Government Department and too much meddling of CSO in the affairs of the Government are what that hampers the Growth and economic progress of the State.

• Contribution to the freedom fighters, for a common cause with shared interest, is the least of the problems. When has it become an illegal taxation when Nagaland statehood was gained in the course of the Naga freedom struggle by the freedom fighters. The only reason the state came into existence. Still the 90-95% of the corruption of the development funds comes from those legal bureaucrats and elected representatives who are responsible for building the state's infrastructure.

• Cannot totally blame on "illegal taxation" as the media and business guilds and security personnel love to associate the degradation of states economy with. People and firms having a "say" on it are equally responsible as well. Had government invest in new firms and new people rather than sharing coffee with the same people and firms time and again, and if people in a position to invest, invest in potential people rather than practicing the infamous art of nepotism and lobbying, economy in the state must have taken off some time ago.

• Corruption is the biggest hindrance to economic development. So called Illegal tax is such a scapegoat.

• First of all thank you. My answer is Others. Because I should say there is no institution or person that understands what it means by law and this happens from the grassroot level. So, there should be a proper panel to elect or select leaders from very optimistic and truthful criteria and rather go by tribe, bribe, tradition, etc.

• Syndicate and taxation.

• It's not the illegal taxes but the immigrants who come from other states and work here in Nagaland and send back the money to their hometown without spending even half of what they have earned. 70% of the Money goes out of state breaking the chain.

• I will go with others. Illegal tax by underground, state police, village councils and Town committee are also part of it but it cannot be fully blamed. To have economic sustainable state government must invest in income Revenue sector. So far Nagaland state only two sector for income Revenue which one of them is private share i.e. power department... PHE is only income Revenue department fully owned by state government. In such condition we cannot expect economic sustainable at all. And those few private companies owned by sons and daughters of ministers do not pay tax to state government which in return some individual ministers are richer than state government. We should question how individual ministers are richer than state government itself. From what source of business they accommodate such money? Rich getting richer and poor get poorer!