Dipankar Jakharia

Gone are the days when for a normal middle class family the only avenue of investment use to be land and gold. Today we have plenty of choices! But then again, when we shop for dresses, gadgets or any other personal item we want to be in the beginning of the queue and when we buy any financial product we want to be at the end of the queue. This is because when it comes to investing money most of us try to fit-in on others shoes. What is best for your neighbour may not be good for you, on a contrary may be counterproductive.

Investment is no more a science, now a day it is considered an Art!

Basics of Investing:-

• You have heard it before, but I’ll say it again “Never put all your eggs in a single basket”

One of the most reliable ways to maximise your long-term returns and reduce the risk of losing money is by diversifying your investments. By spreading your money across different asset classes, regions, sectors. It can be a mixture of Stocks, Bonds, Gold, Property, Fixed Deposits etc.

• Keep it regular!

If you want your six packs you have to exercise regularly. There is no magic one time tablet. By investing a set amount regularly, you remove the emotion from the investment decision and ensure you don't get caught up in the market hype and noise.

Understanding Risk

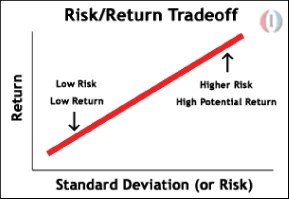

All investments carry some level of risk. The key is making sure you make the right decisions based on your individual circumstances, and take into account the level of risk you are willing to take.

The risk profile you choose reflects your perception of the acceptable trade-off between risk and the reward required for taking on that investment risk.

If you are willing to accept a high degree of risk, then the high-risk, high-return investment may be a viable alternative for wealth accumulation purposes. In contrast, if you are risk-averse person, you may find that a small decline in the investment may cause undue anxiety. If the possibility of such loss would make you lose sleep at night, a conservative low-risk, low-return, safer investment might be better option for you.

The other factor that affects your risk profile is the investment time horizon. As a long-term investor, you can afford to assume greater risks for better potential returns. However, as the horizon shortens, the risk of loss from shortfalls increases, overall risk profile of the investment declines.

Choosing the right investment for your risk level

Every investor's risk tolerance is different. In choosing any investment the factors you should consider include:

• Your investment goals

• Your expectations for returns

• The length of time you can hold your investment

• How comfortable you are with fluctuations in the value of your investment.

Investor risk profiles – which fits you?

• Conservative - an investor who seeks to protect their accumulated wealth and is only prepared to accept a relatively low level of risk. Recommended for Investor <Age55

• Balanced - an investor who seeks an investment that provides a mix of income and growth, should be stable in value over a 3-year period, but could fall in value by 5-10% within a year. Over the long term this strategy could provide a return of 9-11%. Recommended for Investor<Age45

• Growth - an investor who seeks more growth than income with an overall investment portfolio that could provide growth of 12-15% over the long term. The flip side is that in any one year it could fall by as much as 20% in value. Recommended for beginners

• High Growth/Aggressive - an investor who predominantly seeks growth assets that could provide returns of greater than 15% over the long term. The flip side is that in any one year it could fall by greater than 20% in value. Recommended rarely

You should assess your risk profile based on a full risk assessment looking at your needs and investment goals, before deciding on any investments.

......... to be continued.