1

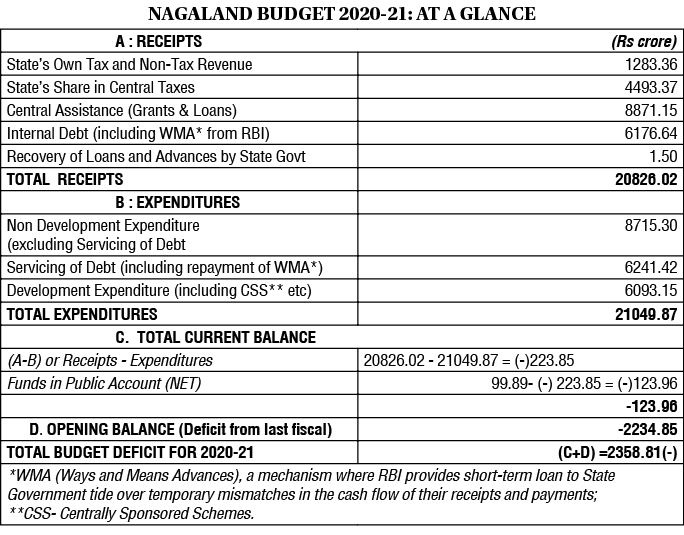

BUDGET: The term “Budget” is not used anywhere in the Constitution of India. The expression used in the Constitution is the “Annual Financial Statement” (AFC). The Budget of the State Government is AFC which includes the estimates of Receipts and Expenditure of the State for the financial year which runs from April 1 to March 31.

ANNUAL FINANCIAL STATEMENT (AFC): The AFC is a summary of the transactions of the State Government and shows the receipts and payments of the Government under the three parts. The AFC is further divided into three- Statement-I dealing with the receipts and disbursements under the Consolidated Fund; Statement-II - receipts and disbursements under the Contingency Fund; and Statement-III - receipts and disbursements under Public Account.

(i) Consolidated Fund: All revenues received by Government, loans raised by it, and also its receipts from recoveries of loans granted, form the Consolidated Fund. All expenditure of the Government is incurred from the Consolidated Fund and no amount can be withdrawn from the Fund without authorization from the Legislature except for certain items classified as ‘charged’ expenditure.

(ii) Contingency Fund: Under Article 267 Clause (2) of the Constitution, the State Legislature may, by law, establish a Contingency Fund in the nature of an imprest (fund) for meeting unforeseen expenditure of any urgent nature which cannot be postponed without detriment to public interest. With the formation of Nagaland State, the Nagaland Contingency Fund Act, 1964 was passed and consequently, the Nagaland Contingency Fund was formed with a corpus of Rs. 35 lakhs appropriated from the Consolidated Fund.

(iii) Public Account: Besides, the Consolidated Fund, certain other transactions enter Government accounts, in respect of which, Government acts more as a banker, for example, transactions relating to Provident Fund, small savings collections, other deposits, etc. The moneys thus received are kept in the Public Account and the connected disbursements are also made from it. Generally speaking, Public Account funds do not belong to Government and have to be paid back some time or the other to the persons and authorities that deposited them. Legislative authorization for payments from the Public Account is, therefore, not required.

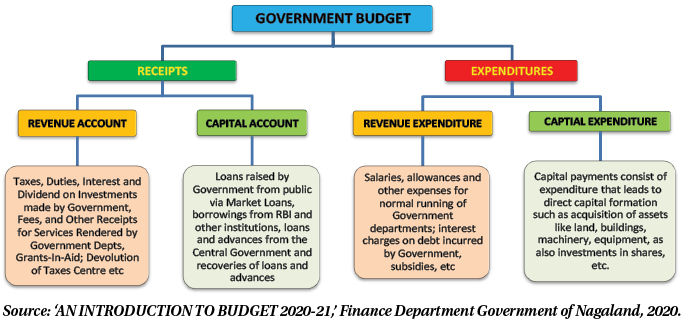

BUDGET ACCOUNT: A Government Budget comprises (A) Revenue Account and (B) Capital Account.

A. Revenue Account: consists of the revenue receipts of Government (tax revenues and non-tax revenues) and the revenue expenditure.

Revenues comprise proceeds of taxes, duties, interest and dividend on investments made by Government, fees, and other receipts for services rendered by Government. It includes grants-in-aid and devolution of taxes from the Government of India.

Revenue expenditure is the estimated cost on salaries, allowances and other expenses required for the normal running of Government departments and various services, interest charges on debt incurred by Government, subsidies, etc.

Broadly speaking, expenditure that does not result in creation of assets is treated as revenue expenditure.

(B) Capital Account: It consists of capital receipts and payments. The main items of capital receipts are loans raised by Government from public which are called Open Market Loans, borrowings from Reserve Bank of India and other institutions, loans and advances from the Central Government and recoveries of loans and advances.

Capital payments consist of expenditure that leads to direct capital formation such as acquisition of assets like land, buildings, machinery, equipment, as also investments in shares, etc. The cost of constructing or acquiring an asset of a lasting nature, which yields revenue or which avoids a recurring commitment is generally classified as capital expenditure. Capital Expenditure may be met from the annual revenues of the Government as well as from money borrowed from the public or the Central Government or from any other available source.

APPROPRIATION: If the Legislature approves the budget, the Government then accords sanction to incur expenditure as detailed therein. This is called the Appropriation. Usually, the Budget is presented to the Legislature sometime in March. The Appropriation Bill is usually passed before the beginning of the new financial year, i.e., before 1st April. Whenever it is not possible to pass the Appropriation Bill for the new year before 1st April the requirements of administration for the first few months of the next year are met by obtaining an advance grant from the Legislature known as “Vote on Account”. The amounts provided in the Vote on Account are subsequently merged with the amounts provided in the Appropriation Bill for the whole year.

CONTROL OVER PUBLIC FUNDS: The control intended to be exercised by the Legislature over the Executive in spending public funds can be effective only if there is somebody to watch on behalf of the Legislature, the actual progress of expenditure. The function is exercised by the Comptroller and Auditor-General (CAG), an authority under the Constitution independent of the Executive and answerable only to the President. The Accountant General (AG) Office of a State under CAG watches all the payments ordered by or on the authority of the Government and examines any serious financial irregularities committed by the Executive, say for instance, spending in excess of the sanctioned grants, allowing grants to lapse, failure to collect taxes in time, wasteful expenditure, etc.

This report is examined by a Committee of the Legislature, called the Public Account Committee (PAC), which is assisted in its deliberations by the AG. It considers the explanations offered by the Executive for the objections pointed out in the report. The recommendations of the PAC are placed before the Legislature. Thus, the Legislature does exercise a reasonable measure of control over the financial transactions carried out by the Executive.

(MExN)

(With inputs from ‘AN INTRODUCTION TO BUDGET 2020-21,’

Finance Department, Government of Nagaland, 2020)