On a lazy Sunday afternoon, the conversation continued. Actually, my friend Abel had got his yearend bonus from his office. And his six year old Fix Deposit has also become mature. And after three years, a hike in their salary is doing the rounds in his office. To sum it up, Abel was a happy man. He insisted we should party and hit our favourite restaurant, and the treat will be his. But being Sunday, I refused. So we settled in my veranda with a black tea in my cuppa and a home / wife made espresso coffee in his.

“Money is everything” said elated Abel.

: Is it?......... I replayed.

: Ok........ It is not everything, but almost everything!

: Maybe you are correct.

: What do you think? Should I buy the latest sedan car, I was eying?

: Maybe you should!

Abel is my friend for several decades. In fact we did our schooling together.

“So you are saying I should not” said Abel with a deeper voice.

Frankly speaking he knew what my answer would be. But just to make his doubts cleared the conversation happened. And he was not reading my words but my tone.

Money plays an important part in our life! In today’s modern world Money is used as an exchange medium for goods and services we receive or give. That means from sunrise to sunset, either we are earning or spending money.

There is also a third prospect of money which is Investing. And by investing you are letting it play even when you are sleeping. First step of investing is by doing something by yourself. With your money you can plant some trees of value or open a shop or do any business of your choice. Here you are in control of your own affairs. So to say, you are the driver of your bus! But what if you are already doing something else? In that case you can give your money to someone else to play with, for a fee.

There are two ways, that you can let others play with your money. Let us understand it by one example.

In our neighbourhood there are three bakeries. Out of all three, Sing Bakery is the biggest and the brightest. Quality of its products and services rendered are far superior then other two. In last one decade I’ve seen it growing exponentially.

Now Singh Bakery’s owner Mr. Sing offered me two deals. To expend his business more he needs money. “If you lend me, I’ll give you X amount as interest every month. But if you became my partner, then my profit is your profit, my loss is your loss”

He did put two propositions on my table. For a risk free fix income he’ll offer me a pre defined interest. Here I don’t have to worry about his state of business. But in the second offer I’ve to trade a higher degree of risk in anticipation of a greater return. Here the trick of the game is........ is it worth taking the risk or is the risk worth of the anticipated return?

Any kind of Investments with a fixed return falls into the first category. You are simply lending someone for a fixed interest. When you are buying a bank Fix Deposit you are simply lending the bank. When you are buying National Saving Certificate from post office, you are lending your money to the government.

But, buying a share of a company, you become a part owner of the said company. And this is the second category. The maker of the car you drive, the bank that you transact all have shares of it for sale. By buying a share of these companies you become a part owner of the said company, and then their profit is your profit and their loss is your loss. And the trade off you take for a higher anticipated return is the proportionate risk involved in it.

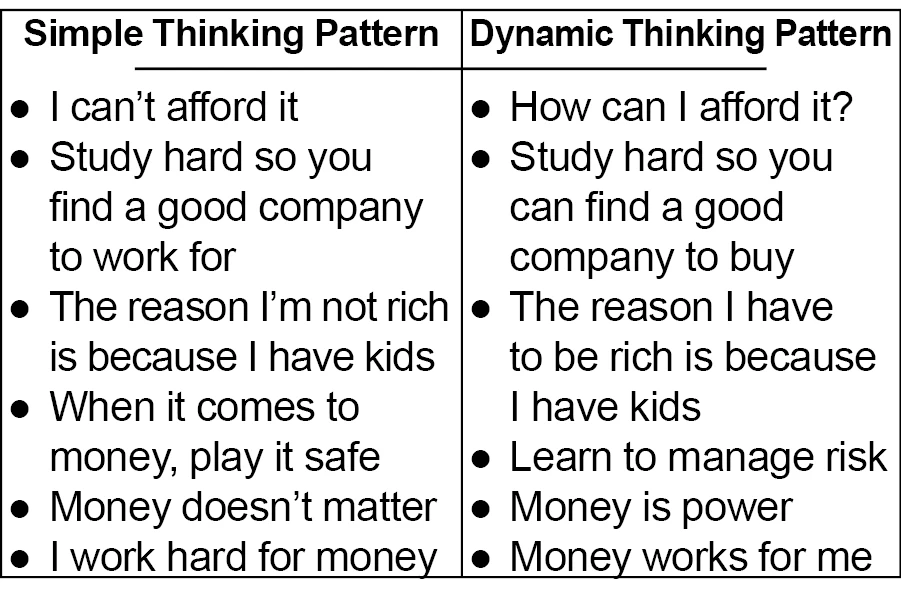

• Never increase your expenses in accordance with your income

• Money can be given to others in two broader terms

• You can lend for a fix income

• Or you can become part of the game for a higher anticipated return

• Younger people have greater risk appetite and should explore the second option.

• The best option is a combination of both, depending on ability and appetite of risk

• It is OK to take little risk

“Things that you should never do is to proportionally increase you expenditure once your income increases.” I told Abel. “Instead you should let it play. Just like our children needs to play for a brighter and a healthier future, your money also need to play!”