Moa Jamir

Morung Express Feature

All eyes would be fixed Nagaland Chief Minister or rather on projected budget deficits, when Neiphiu Rio, who holds the finance portfolio, presents the Nagaland Budget for the financial year 2022-23 on March 22.

Budget simply means “an estimate of income and expenditure for a set period of time,” however; it is not merely about tracking income and expenses, but it spells out the Government’s developmental plans and polices for the immediate financial year as well as future. Accordingly, it is prudent know keys terms used in the budget, through which one can get a fair idea of how the government of the day gets and allocates resources to the various sectors of the economy, including welfare activities.

As Encyclopedia Britannica explains, for modern industrial economies, the budget is the key instrument for the execution of government economic policies.

As the Chief Minister prepares to present perhaps the last budget for the current tenure of the 13th Nagaland Legislative Assembly, here are some key terms one needs to know to understand the budget better. ‘An Introduction to Budget 2021-22,’ a booklet by the Finance Department, Government of Nagaland, which prepares the budget annually, is the main reference for this explanation.

Annual Financial Statement: The term “Budget” is not used anywhere in the Constitution of India, instead the expression used is the “Annual Financial Statement” (AFS) showing transactions of the Government (Receipts and Expenditure) under three heads.

Consolidated Fund: All revenues received by Government, loans raised by it, and also its receipts from recoveries of loans granted by it form the Consolidated Fund. All expenditure of the Government is incurred from this Fund and no amount can be withdrawn from the Fund without authorisation from the Assembly except for certain items classified as ‘charged’ expenditure, not subject to the voting.

Contingency Fund: Under Article 267 Clause (2) of the Constitution, the State Legislature may establish a Contingency Fund for meeting unforeseen expenditure of any urgent nature which cannot be postponed without detriment to public interest. With the formation of Nagaland State, the Nagaland Contingency Fund Act, 1964 was passed and consequently, the Fund was formed with a corpus of Rs 35 lakh appropriated from the Consolidated Fund.

Public Account: Other transactions entering Government accounts in which it acts more as a banker, for example, relating to Provident Fund, small savings collections, other deposits, etc, forms the Public Account. Public Account funds generally do not belong to Government and have to be paid back some time or the other to the persons and authorities that deposited them and do not need legislative authorisation.

Financial/Fiscal Year: According to Collins Dictionary, a financial year is a “period of twelve months, used by government, business, and other organizations in order to calculate their budgets, profits, and losses.” In India, a financial year runs from April 1 of the current year to March 31, the next year.

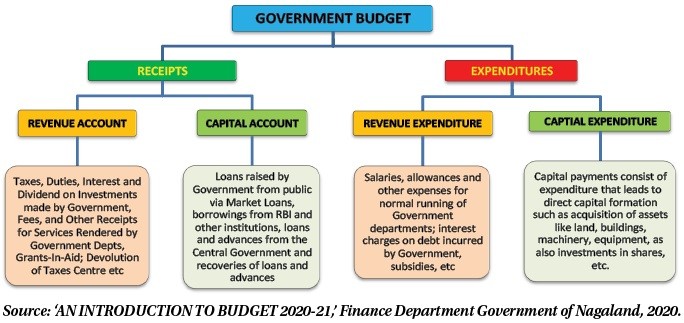

Receipts and Expenditure: Generally, a Budget comprised of receipts and expenditure, which is further divided into Revenue and Capital for both.

Revenue and Capital Receipt: Revenue Receipts consist of those receipts which neither ‘creates liabilities nor reduces’ assets of the government.’ In other words, it is the regular money received by the state government from sources like taxes, duties, dividend on investment, fees on service rendered, Grant-in-aid and share of central taxes etc. The money received by the State government which either ‘creates liabilities or reduces’ assets are called Capital Receipts. Money received via loans, borrowing and recovery of loans, disinvestment etc are considered capital receipts as it involves either losing something or having future obligation.

Revenue and Capital Expenditure: Those expenditure which neither ‘creates assets nor reduces liabilities of the government are denoted as revenue expenditure. Payment for salaries, allowances and other expenses for normal running of government, interest on past debts, subsidies etc are revenue expenditure. In other words, neither new asset is created nor its obligations reduced when government incur such expenditure.

Capital Expenditure, on the other hand, implies spending on either creating assets or reduces liabilities of the government. It consists of expenditure which results in direct capital formation such as construction of building, purchased of land, machinery and tools, investments, repayment of loans etc, thus creating assets and reducing liabilities.

A low revenue expenditure and high capital expenditure is generally preferred for progressive economic growth of an economy.

Budget Deficit and Surplus: When estimated Receipts the government is equal to estimated Expenditure, it is usually considered balanced budget. However, in practice, a government budget is usually a surplus (receipts greater than expenditure) and mostly deficit (expenditure over receipts).

For a developing economy, a deficit budget is considered favourable if expenditure incurred is spent on creating assets and other welfare programme, not on revenue expenditure. Regardless, an unchecked increase in deficits are considered detrimental for the economy, as it is usually meet by more borrowing, increasing liabilities or increasing or new taxes, effecting the general population.

Appropriation: If the State Assembly approves the budget, the Government then accords sanction to incur expenditure as detailed the budget. This is called the Appropriation. Usually, the Budget is presented in the Assembly sometime in February/March, the Appropriation Bill is usually passed before the beginning of the new financial year, i.e., before April 1.

Controls over funds: The Legislature exercise control over the Executive (government of the day) in spending public funds through the Comptroller and Auditor-General (CAG), an independent authority under the Constitution and answerable only to the President.

The Accountant General (AG) Office of a State under CAG watches all the payments ordered by or on the authority of the Government and examines any serious financial irregularities.This CAG report is examined by a Committee of the Legislature, called the Public Account Committee (PAC), and after considering the explanations offered by the Executive, its recommendations are placed before the Assembly.