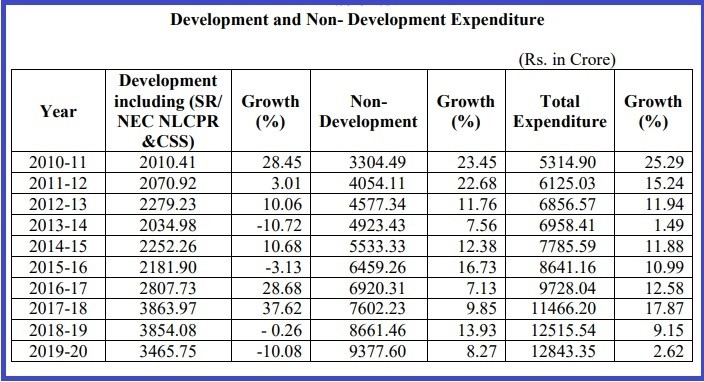

Development and Non- Development Expenditure as per the Statements under The Nagaland Fiscal Responsibility and Budget Management Act, 2005 laid in the Nagaland Legislative Assembly along with the Budget 2021-22.

Our Correspondent

Kohima | February 18

Stating that the finances of the state during 2020-21 has been severely affected due to the lockdowns during the pandemic, Chief Minister Neiphiu Rio said that “as a result the State’s revenue receipts - both from our own resources as well as Share of Union Taxes and Duties have fallen far below initial estimations projected in the budget.”

Going by present trends, the state own revenues are expected to fall by about 10% from the budgeted figures.

Against a Budget Estimate figure of Rs 1283.36 crore it is now estimated at Rs 1197.17 crore, a shortfall by about Rs 86.19 crore.

The major setback has been the fall in the share of Union Taxes & Duties. Against the amount of Rs 4493.37 crore shown in the Budget Estimate of the Union Budget, it is now reduced to Rs 3151.38 crore in Revised Estimates, a shortfall of Rs 1341.99 crore.

“To avert a potential financial collapse we had to resort to austerity measures to offset the revenue losses by curtailing expenditure both under Non-Development and Development (State Resources) funds,” Rio stated.

Under Non-development we have, like the Central Government, frozen the payment of three installments of Dearness Allowances and Dearness Relief payable to the State Government employees and pensioners.

The expenditure under various items such as Office Expenses, Travel Expenses, Motor Vehicles and Maintenance under Non-Development were also reduced by 15 %. Purchase of new vehicles and fresh appointments under the State Government has also been put on hold, he said.

In addition, there has been 15 % reduction in the Development Outlay given to various departments.

These measures have helped to keep the deficit within manageable levels. But the huge salary expenditure due to the high number of Government employees leaves us with meagre funds for developmental activities, and continues to be an area of concern. My Government will keep making efforts to bring down salary expenditure so that more funds can be earmarked for development, Rio said.

Goods and Services Tax

Rio said that pandemic had a huge negative impact on GST collections which constitutes the largest source of our own revenues.

Against the Budget estimates of Rs 844.49 crore for 2020-21, the Taxes Department has so far collected Rs 506.20 crores as of November 2020.

This constitutes 59.95% of the target set. On the whole, revenue collections are behind the collections for the same period of last year. However, following the lifting of the lockdown restrictions and intensive drives undertaken by the department, GST collections have shown some improvement during the second quarter. This improvement is due to the resumption of business activities in all parts of the State, Rio said.